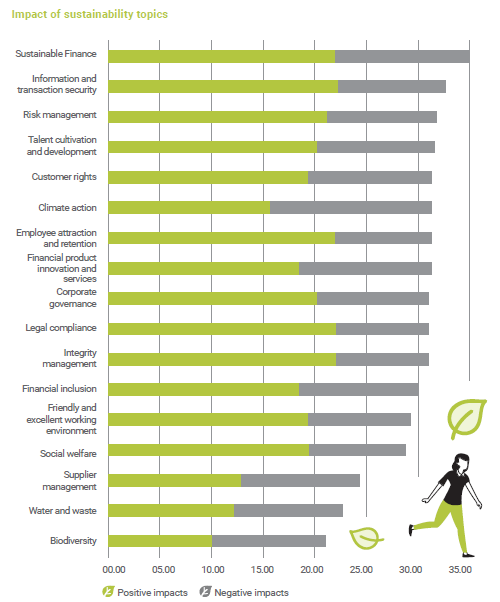

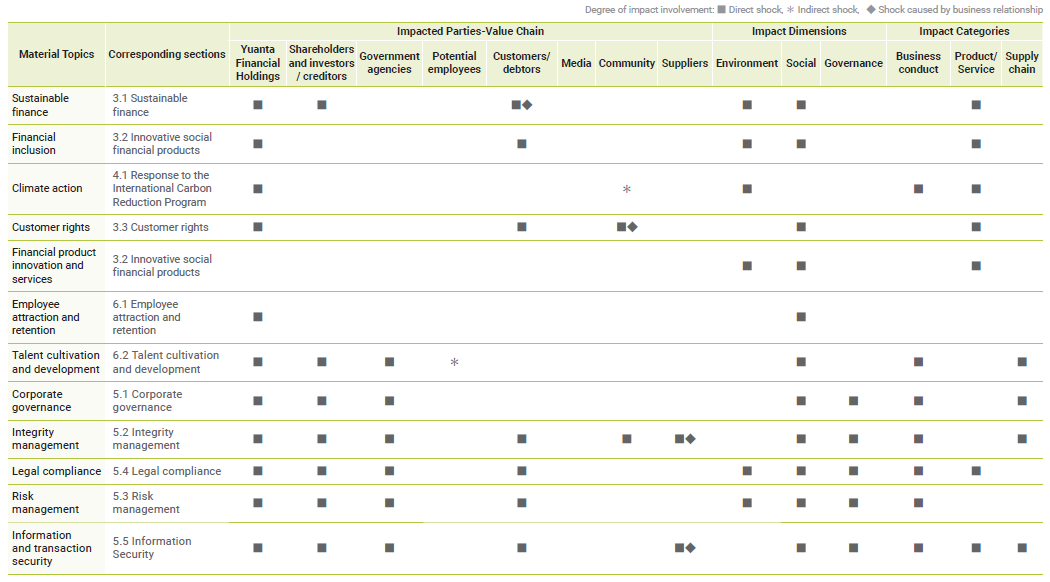

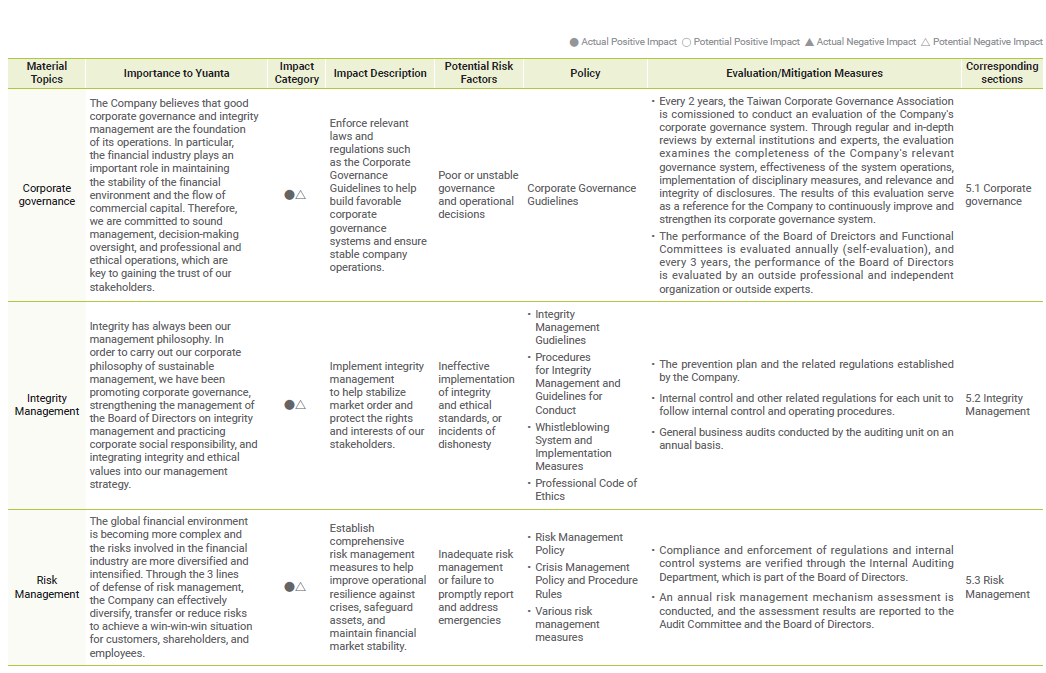

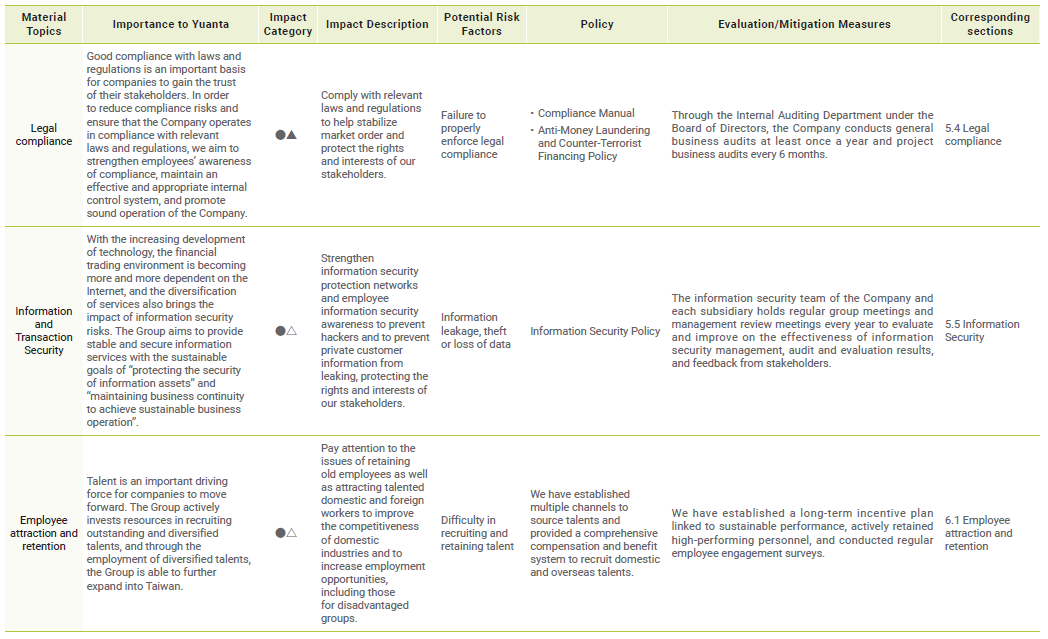

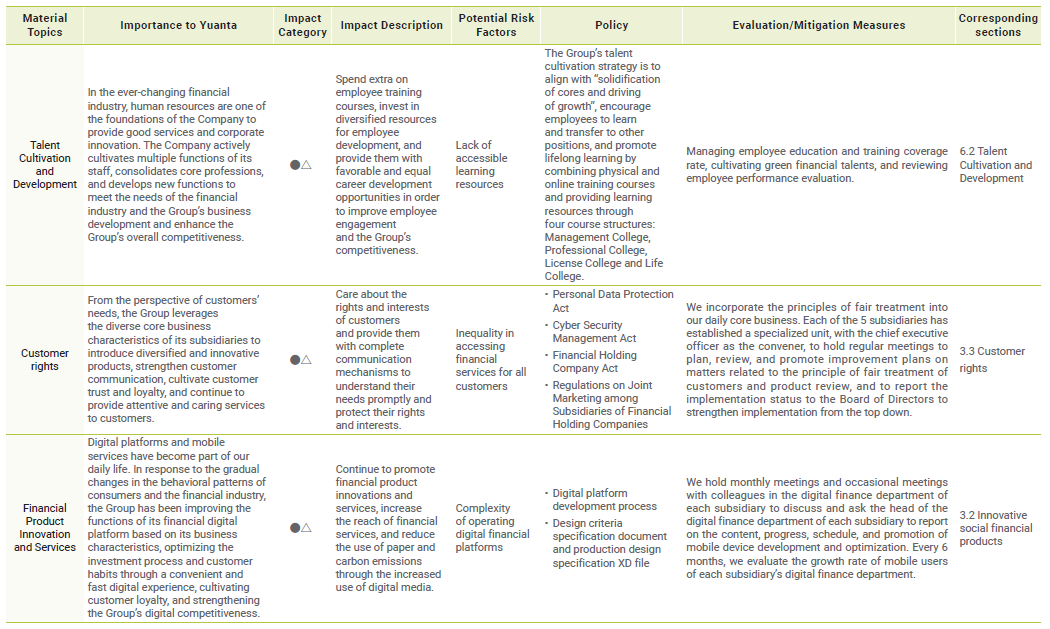

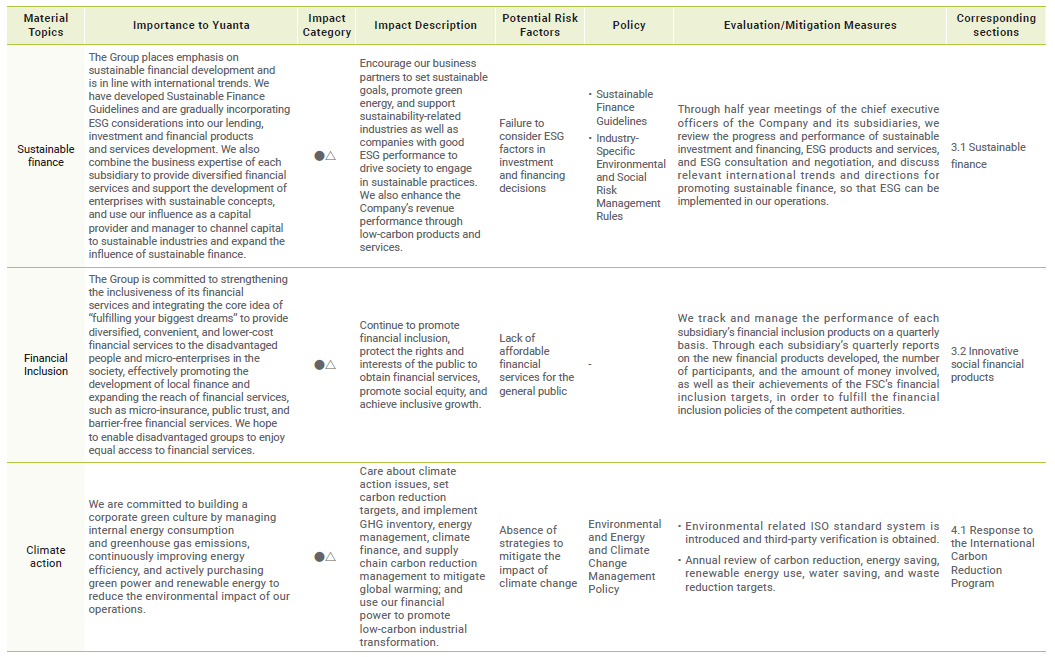

Our Company values the views of our stakeholders. Our stakeholders include shareholders and investors/creditors, government agencies, customers/debtors, current employees, potential employees, media, communities, and suppliers. We employed various channels and stakeholder communication to understand and identify their concerns. The Company conducts material assessments and reviews every year, of which the results are presented, along with the potential internal/external risks of financial-related business, and presented reports to the Board of Directors to implement Enterprise Risk Management (ERM).

The material topics of 2023 were evaluated and adjusted in accordance with the GRI Standards: Universal Standards and the practical situations reflected within and outside the Company, through discussions and joint decisions made by the head of the Corporate Sustainability Office and the group leaders. In response to these material topics, corresponding management policies and concrete actions are disclosed, and the assessment process and identified material topics are as follows:

元大金控

元大金控