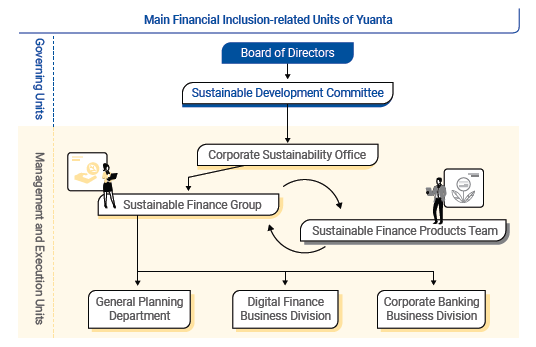

The Group's inclusive finance policy outlines key strategic directions aimed at enhancing internal management processes and personnel training to improve the effectiveness of product and service development. This is done in coordination with risk management policies to provide suitable financial and non-financial products and services according to the needs of different demographic groups and the business attributes of each subsidiary. Additionally, we have established effective and understandable communication channels, with increasingly stronger partnerships and external advocacy to help build the financial literacy of target groups. The goal is to construct a comprehensive inclusive finance ecosystem from the inside out.

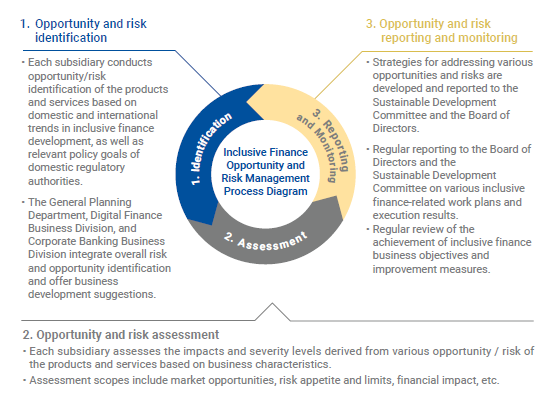

Each subsidiary of the Group regularly conducts identification and assessment of inclusive finance opportunities and risks based on its business characteristics. Relevant products and services are developed in accordance with domestic and international market trends and regulatory policy directions, with financial opportunities and risks measured to formulate business promotion strategies and risk response measures. The main products and services of inclusive finance in the Group are as follows: fractional share trading, regular investment plans for stocks/funds, loans for small/medium/micro enterprises, and "Quasi long-term care," "small amount endowment," and "micro" insurance. Some businesses are involved with financial risks such as credit risk and insurance risk, which corresponds to transaction fee income, loan interest income, premium income, and other potential financial opportunities creating the expansion of the financial assets scale.

Based on evaluations conducted by relevant units within the Group in 2023, the financial opportunities and risks associated with the main products and services of inclusive finance were assessed. Currently, these business activities account for a relatively low proportion of each unit's operations. Despite limited profitability, financial risks also fall within the risk appetite and limits. Therefore, the overall impact of inclusive finance business on the Group's financial condition, financial performance, and cash flow is not significant.

The Group considers domestic and international trends in inclusive finance development, as well as regulatory policy directions, for the establishment of systematic management indicators and goals, such as the number of account holders for regular investment plans in stocks or funds with scheduled deductions and the amount of premiums for microinsurance. We implement tracking and improvement measures for the effective promotion of inclusive finance by refining the Company's inclusive finance policies in line with current developments.

元大金控

元大金控